Budget

The Executive Office is responsible for sound financial planning through annual preparation and regular review of the County budget.

It publishes the County's budget document every year. This document reflects the County's organizational values by attempting to strike an appropriate balance between financial detail and discussion of the bigger picture. It is intended to inform a meaningful discussion about resource allocation decisions among the public, the Board of Supervisors, and staff.

Services

Official County Annual Reports

About the County's Economic Strategy

Budget Development and Management

FAQs

The County's budget is perhaps the most important document published by the County of San Luis Obispo. It serves as the most concrete expression of public policy. Think about your personal finances. How you spend your money reflects your goals. Similarly, how the County spends public funds reflects what the County hopes to accomplish in a given fiscal year. The budget is tied to priorities, plans and specific projects approved by the County Board of Supervisors.

Property taxes are collected and distributed to local schools, the County general fund, cities, and special districts. Generally, the County receives 23 cents for every tax dollar collected. About 61 cents goes to local schools, 6 cents goes to special districts, and 10 cents goes to local cities. Incorporated cities (cities with their own City Councils) have their own government and budgets independent of the County and provide many of their own local services, such as police and fire.

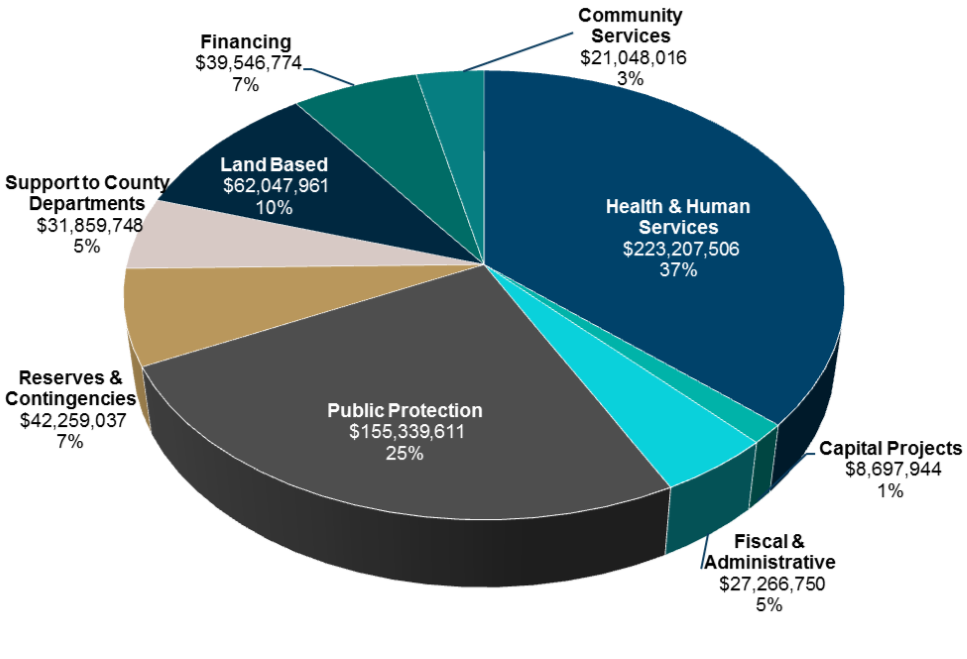

The majority of government funds are spent on health and human services (such as Public Health, Social Services, etc.) and public protection services (such as the Sheriff's Office, Probation Department, County Fire Department, and the District Attorney's Office). To give you an idea of what that looks like, the pie chart below shows how much of the County's $611.3 million were divided up among various public service group in FY 2017-18.

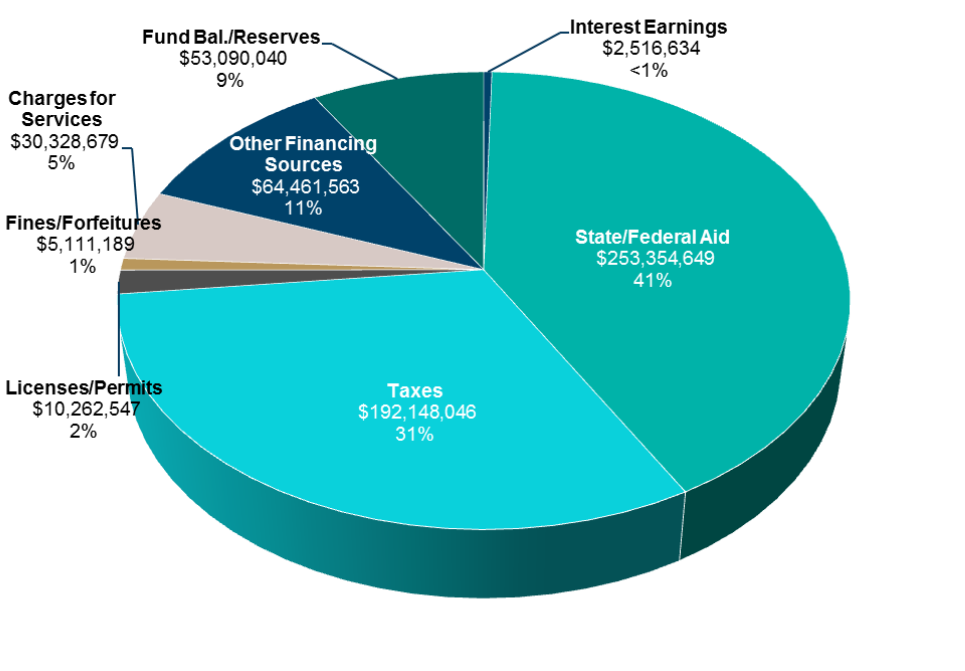

Contrary to popular belief, the County's revenue does not come solely from property taxes. In fact, only about 31% of the County's revenue in FY 2017-18 came from taxes, while 41% came from State and Federal Aid, 11% came from other financing sources, 9% from balance leftover from the previous fiscal year and/or reserves (savings), 5% from charges for services, 2% from license and permit fees, 1% from fines and forfeitures, and less than 1% from interest earned on various accounts. Here's a breakdown of what that looks like: