Choosing A Medical Plan

Key Considerations

Unsure which medical plan is right for you? Here are some key items to consider when selecting a medical plan:

- Your Doctors – Do you prefer to see specific doctors? Visit the Blue Shield's website to confirm your doctors are in-network before enrolling in a plan. If your doctor is not in network, a visit will cost you more. A few minutes of research can avoid an expensive surprise.

- Your Healthcare Needs – Do your family members need to see a doctor often or visit urgent care? Do you have regular lab work or X-rays? Do you take medications on an ongoing basis? Do you have surgery planned? Review the side-by-side medical plans in the current Employee Benefits Brochure.

- Your Total Cost – How much will be deducted from your pay for coverage? Does the plan have a deductible? What is the plan's annual out-of-pocket maximum? Can you offset your costs with a tax-free health account such as an HSA or an FSA? Each of these factors can affect your bottom-line cost for healthcare.

Visit the Compare Medical Plans webpage to learn more about the different medical plans available to you. Understand the difference between the different types of plans (PPO, EPO, HDHP) by reviewing the sections below. To better understand the terms used in medical plans, review the key terms section.

Medical Plan Types and Terms

A PPO gives you flexibility and choice, but you might pay more. You can go to any doctor without a referral, but you will pay more of the cost if they are not in the plan's network. You’ll need to meet an annual deductible before the plan starts to pay.

The County PPO plans coordinate with Express Scripts for your pharmacy benefits.

The County offers three PPO plans with differing premium costs, provider networks, and out of pocket maximums. Please review the table below for a comparison.

An EPO gives you more predictable costs but less flexibility. Out-of-network care is not covered except in an emergency. You pay a fixed copay for most services.

The County EPO plan coordinates with Express Scripts for your pharmacy benefit.

You're in the driver’s seat when it comes to managing your medical care and finances. A HDHP is the only plan with a Health Savings Account (HSA) funded by your own tax-free dollars and any employer contributions. The HSA helps you pay your deductible and other healthcare expenses. HDHPs have higher annual deductibles and out-of-pocket maximum limits than other PPO plans. You can visit any provider, but if you stay in-network, you’ll be able to save more of your HSA dollars for future healthcare needs.

With a HDHP, the annual deductible must be met before plan benefits are paid for services, other than in-network preventative care services, which are 100% covered. Once your annual out-of-pocket expenses for covered services from in-network providers, including deductibles, copayments, and coinsurance, reaches the pre-determined out-of-pocket limit, the plan pays 100% of the allowable amount for the remainder of the calendar year. You are required to meet your medical annual deductible for both medical expenses and prescription drugs before the plan's coinsurance cost sharing begins. This means you pay the full cost of your medication until you reach your deductible, not a co-pay.

Another key difference between the HDHP and PPOs/EPOs is that under a HDHP, the deductible is aggregate, not embedded. Lastly, note that the HDHP has a separate deductible for in-network services and out-of-network services, so it is advised you try and stay in-network as much as possible.

The County HDHP coordinates with Blue Shield Rx for your pharmacy benefit. Beginning January 1, 2025, Amazon Pharmacy will be utilized for Home Delivery medications.

| Blue Shield Tandem | Blue Shield Choice | Blue Shield Care | |

|---|---|---|---|

| Network | Narrow Network of Providers | Larger Network of Providers | Larger Network of Providers |

| Out of Pocket Maximum | Higher Out of Pocket Maximum | Higher Out of Pocket Maximum | Lowest Out of Pocket Maximum |

| Premium Costs | Lowest Premiums | Higher Premiums | Highest Premiums |

Understanding key terms in the world of medical coverage is a crucial step in selecting the best plan for you. Let's look at six key terms you will see when selecting a medical plan:

| Term | Explanation |

|---|---|

| Eligible Expense | A service or product that is covered by your plan. Your plan will not cover any of the cost if the expense is not eligible. |

| Deductible |

The fixed dollar amount you must pay every calendar year before your cost sharing of medical expenses begins. If your deductible is $500, the plan won't pay anything for most services until you've met your $500 deductible. *Preventative care is excluded and is always 100% covered by Blue Shield with in-network providers, even when you haven't reached your deductible or out-of-pocket maximum. |

| Coinsurance |

After you meet the deductible, you and the plan share the cost on a PPO or HDHP. You will pay a percentage of a covered service while your health insurance plan pays the remainder. For example, if the plan pays 80%, your coinsurance share of the cost is 20%. You are billed for your coinsurance after your visit. |

| Copay | The amount of healthcare costs you have to pay for with your own money before your plan will start to pay. The copay does not go towards your deductible, but it does count towards your out-of-pocket maximum. |

| Out-of-Pocket Maximum (OOPM) | Protects you from big medical bills. Once costs "out of your own pocket" reach this amount, the plan pays 100% of most remaining eligible expenses for the rest of the plan year. This is the most you have to pay for covered services in a plan year. |

| Balance Billing | In network providers are not allowed to bill you for more than the plan's allowable charge, but out-of-network providers are. This is called balance billing. For example, if the provider's fee is $100 but the plan's allowable charge is only $70, an out-of-network provider may bill you for the $30 difference. |

When it comes to the financial side of insurance, understanding key terms is essential when utilizing and budgeting for your care needs. Check out the video and image below for a deeper dive into Key Medical Insurance Terms.

The County's High Deductible Health Plan (HDHP) has an aggregate deductible, but an embedded out-of-pocket maximum. Blue Shield Tandem, Choice, Care, and the EPO all have an embedded deductible and out-of-pocket maximum.

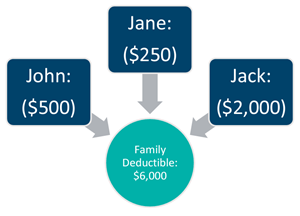

To help understand the difference, assume you have a family of three with the following scenario:

- Annual Deductible

- $2,000 (Individual)

- $6,000 (Family)

- Medical Expenses for Each Family Member:

- John: $500

- Jane: $250

- Jack: $2,000

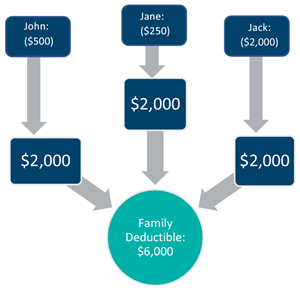

| Aggregate | Embedded |

|---|---|

| With an aggregate family deductible, your family will be paying the deductible until the entire family deductible is collected. | With an embedded family deductible, the plan begins to make payments as soon as one member of the family has reached their individual deductible. |

|

|

|

Jack and his family are enrolled in the HDHP. Jack trips and sprains his wrist and needs to go to the emergency room. Will the co-insurance kick in immediately, since he has already met the $2,000 individual deductible? |

Jack and his family are enrolled in the Blue Shield Choice plan. Jack trips and sprains his wrist and needs to go to the emergency room. Will the co-insurance kick in immediately, since he has already met the $2,000 individual deductible? |

| NO. The family has only had a total of $2,750 in medical expenses. Jack will need to pay the remaining $3,250 of the family deductible before the co-insurance will take effect. Once the co-insurance is in effect, he will only need to pay 20% of the remaining emergency room expenses | YES. Jack only has to meet this individual deductible of $2,000 and he has already had $2,000 in medical expenses. Jack's Blue Shield Choice plan will help pay for his trip to the emergency room, and he is only subject to the co-insurance. However, if anyone else in the family had tripped instead of Jack, the co-insurance would not kick in for them until they hit their $2,000 individual deductible. |