Updated Program for Delinquent Property Tax Penalty Waivers (Update: The State program has ended)

Author: James W. Hamilton, CPA

Date: 12/7/2020 2:30 PM

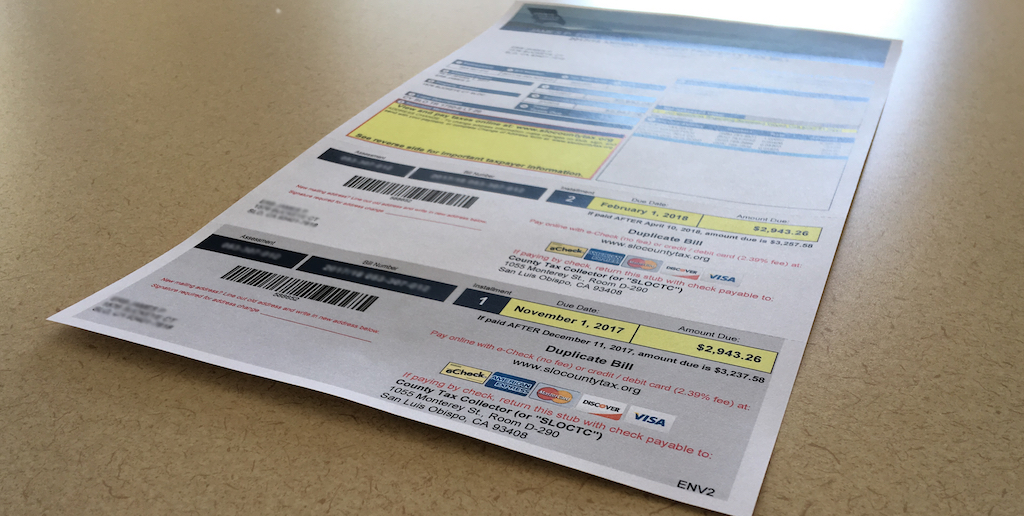

San Luis Obispo County Tax Collector Jim Hamilton announced an updated program for taxpayers to request waiver from FY 2020-21 property tax late charges incurred due to COVID-19 hardships. This announcement follows information released on March 20, 2020 announcing a waiver program for FY 2019-20 installments.

Update: The state program which allowed additional leniency for delinquent property tax payments due to the COVID emergency ended on May 6, 2021. To see if you qualify for penalty cancellation under current state law, please see our page on penalty cancellation requests.

Original Article:

“Recognizing many taxpayers continue to face difficulties meeting property tax deadlines we have continued our commitment to provide relief where allowed under State Law. Prior to the issuance of orders from the State we designed a local waiver program for last year’s installments. We are currently following State Orders now in place. Taxpayers able to pay installments on time should do so, but this program allows more time for those who have been impacted by COVID-19,” said Hamilton.

State Executive Order N-61-20 issued by the Governor allows property owners to request a penalty waiver on their primary residence and also allows for penalty waivers for small businesses experiencing COVID-19 related economic hardship to avoid late-payment penalties for real property taxes due after April 10, 2020, through May 6, 2021. Taxpayers requesting waiver must submit a Waiver Request Form at the time they make their tax payment. In accordance with order N-61-20 all requests for a waiver of penalties and interest must be received by the Tax Collector with payments on or before May 6, 2021. Payments received after May 6, 2021 are subject to late charges.

Properties eligible for a penalty waiver are the taxpayer’s primary residence or properties associated with a small business, including vacation rentals. More details and a Waiver Request Form are available online at www.slocountytax.org.

Taxpayers with questions about the waiver request process can contact the Tax Collector’s office at [email protected] or by phone at (805) 781-5831, Monday through Friday, 8 a.m. to 5 p.m.