Last Day to Pay First Installment of Annual Secured Property Taxes Without Penalty is December 11th

Author: Auditor-Controller-Treasurer-Tax Collector

Date: 11/21/2017 12:01 PM

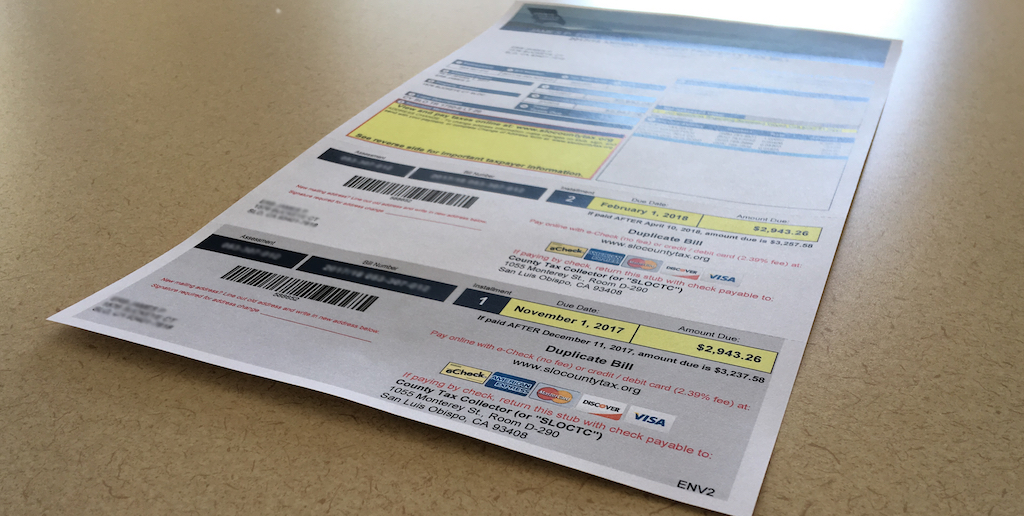

Pay the 1st Installment of Annual Secured Property Taxes by December 11th to avoid a 10% penalty.

Jim Erb, the County Auditor-Controller-Treasurer-Tax Collector, reminds all County Taxpayers that the delinquency date for the first installment of this year’s secured property tax bills is rapidly approaching.

“California law requires that we add a 10% penalty if payments are not made by the delinquency date. Because December 10th is on a Sunday this year, taxpayers have until December 11th to make their payments”, said Erb.

Payments may be made:

- At the Tax Collector's website before midnight Monday, December 11th on the Tax Collector's website.

- By mail before midnight on December 11th.

- At the Tax Collector's Office, Room D-290 until 5:00 p.m. December 11th.

- Please note that eChecks can be made with no additional fee, however credit and debit card payments require an additional 2.39% processing fee ($3.95 minimum).